By Ken McCarthy

Principal Economist/Cushman & Wakefield

In 2018 the technology sector in the U.S. cemented its position as a major driver for the U.S. economy and office market. Funding for tech-related businesses soared and the number of companies with valuations of $1.0 billion or more—popularly known as Unicorns—reached a record 156. Venture capital investments roughly doubled in 2018, rising from $72 billion in 2017 to $131 billion in 2018, the largest amount invested by venture capital funds since the all-time high of $188 billion in 2000.

With that much money being poured into the tech sector, it’s no surprise that there was also a surge in tech sector leasing during 2018. In fact, the tech sector was, by far, the largest lessor of office space in the U.S. in 2018, accounting for more than a quarter (26.7%) of the 311.9 million square feet (msf) of new leases signed in the U.S.

When looking at the 40 largest leases from each of the 86 office markets tracked by Cushman & Wakefield, a clearer picture of the impact of the tech sector on the commercial office market in the U.S. materializes.

Tech is Big. Tech companies continued to gobble up space at a rapid pace in 2018 and dominated leasing overall. An analysis of jumbo leases, those of 400,000 square feet (sf) or larger, shows this dominance. There were 35 new jumbo leases signed in 2018 for a total of 20.9 msf. In comparison, there was roughly half that number in 2017: 18 jumbo leases and representing 9.6 msf.

The tech sector was the most important reason for that increase in jumbo leases. In 2017 tech leases accounted for seven of the jumbo leases signed and for 3.8 msf—or 40%—of total jumbo leasing volume. There were 18 tech-sector jumbo leases in 2018, with a total leased square footage of 11.4 msf. The tech sector accounted for 7.6 msf or two-thirds of the increase in jumbo lease square footage between 2017 and 2018.

The rapidly expanding pharmaceutical and life sciences component of the tech sector was a big contributor to this increase. In 2017 this sector represented 600,000 sf of jumbo leasing volume, and in 2018 that number jumped to 2.5 msf. Looking at all leases, the pharmaceutical and life sciences sector accounted for slightly more than 7.7 msf or 17.9% of tech leasing.

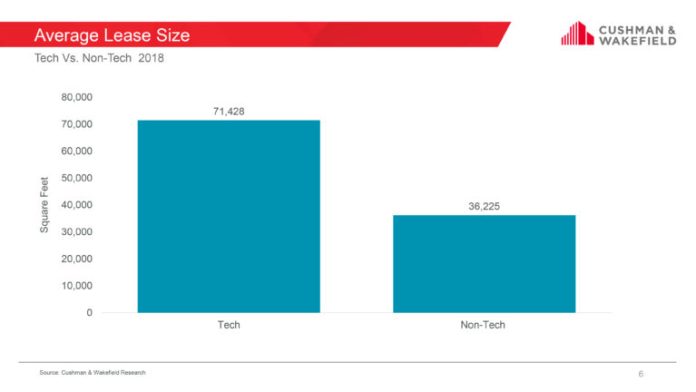

Even among the top leases, tech leases have tended to be larger. The average tech lease from that group during 2018 was roughly 71,500 sf while the average non-tech lease was 36,200 sf.

Tech is concentrated geographically. Tech companies have continued to focus on the core tech centers. Although tech leases were signed in 70 markets across the U.S., our leasing data demonstrates the concentration of the sector. The 10 markets with the largest volume of tech leasing were exactly where one would expect: Silicon Valley, San Francisco, New York, Seattle, Los Angeles, Washington, DC, San Diego, Salt Lake City, Boston and Central New Jersey. Together, these 10 markets accounted for 75% of the tech leasing in the top leases data set.

The outsized contribution of the tech sector to these markets can be seen in the data on total leasing. These same 10 tech-centric markets accounted for roughly 50% of total leasing in the data set even though they represent 36% of the total office inventory in the U.S.

Within several markets, the tech sector dominates leasing. As might be expected, the tech sector accounted for the lion’s share of leasing in Silicon Valley (78.1%) and San Francisco (60.1%). But it was also dominant in some unexpected places in 2018: in Salt Lake City the tech sector accounted for two thirds (66.4%) of the major leases signed, and in Fairfield County, CT tech leases represented nearly 40% of the major leases.

Tech is really a very diverse set of industries. Tech is not just hardware and software; it is comprised of a diverse set of industries and continues to evolve rapidly, adding new industries that didn’t exist a few years ago.

There are a total of 46 individual industries that are in the sector. Tech includes so many different activities—from streaming video, digital advertising and internet publishing to virtual reality, video gaming, cloud computing, cyber security and artificial intelligence. There is also transportation technology such as driverless cars, ride-sharing and the entire life sciences sector. The industry that leased the most space in 2018 was the life sciences sector which accounted for nearly 20% of total tech leasing in 2018, followed by data processing, hosting and related services (i.e., cloud computing) with approximately 15%.

And there’s more. The tech sector is part of just about every major industry. For example, fintech—the use of technology in the financial sector—is exploding. From payment processing and trading algorithms to blockchain payment systems and cyber security, fintech is among the fastest growing employment categories in many financial firms. Also, retail companies are investing heavily in eCommerce technology. While these and many other firms are leasing space for their technology groups, “tech” falls under their base industry.

Conclusions. Most may consider technology as social media, online publishing, eCommerce, internet advertising and streaming technology. Companies providing these services are certainly important, but the leasing data from 2018 show that the tech sector itself has grown and matured. While still centered in the key tech hubs that have been the core tech cities in the U.S. for the past two decades, the sector is also expanding as new technologies and new industries emerge.

One thing is clear. Technology is now the dominant sector in the U.S. office market. Don’t expect that to change any time soon.

Ken McCarthy has been with Cushman & Wakefield since August 2006. As Principal Economist, he works with the Chief Economist on Cushman & Wakefield’s U.S. economic position and presents it to the public. As Applied Research Lead, Ken is responsible for preparing cutting edge research about the outlook for commercial real estate in the Americas.

Ken McCarthy has been with Cushman & Wakefield since August 2006. As Principal Economist, he works with the Chief Economist on Cushman & Wakefield’s U.S. economic position and presents it to the public. As Applied Research Lead, Ken is responsible for preparing cutting edge research about the outlook for commercial real estate in the Americas.